Learn basics of Accounting fundamentals easily

Accounting is art of recording, Classifying and summarizing

of transaction in money or money's worth.

STEPS IN ACCOUNTING:-

Ø

Recording

of transaction: -As soon as transaction happens it is first recorded in

book.

Ø

Journal:

- The transactions are recorded in chronologically (i.e.in order of time from the earliest to the latest).

Ø

Ledger: -All

journals are posted into ledger chronologically.

Ø

Trail

Balance-After closing all Ledgers accounts, a trail balance is prepared at

the end of the period.

Ø

Adjustment

Entries: -All the adjustments entries are to be recorded properly.

Ø

Adjusted

Trail Balance: -An adjusted Trail Balance may also be prepared.

Ø

Closing

Entries: -All the nominal accounts are to be closed by the transferring to

trading account and profit and loss account.

Ø

Financial

Statements: - Financial statement can be prepared after passing closing

entries. Financial statements consists of Balance sheet, Profit & Loss Account

& Cash Flow Statement.

EVENTS AND TRANSACTIONS

Event is a transaction or change recognized on the financial

statements of an accounting entity. The events are both external and internal. An

external event is occurred outside the entity Ex: - Purchase or sales. An

internal event would involve change in the accounting policies Ex:- Change in

Deprecation method from Straight Line method to Written Down Value Method.

Transaction is exchange of an asset with consideration of

monetary value. Ex:-Purchase of goods or sale of goods, so all transactions are

events but all events are not transactions.

VOUCHERS

A voucher is a document that shows services or goods

received, payment authorized .It is a written instrument that serves to confirm

or acts as an evidence for a fact for such respective transaction.

Types of Vouchers :

I.

Receipt voucher

II.

Payment Voucher

III.

Non Cash or Transfer Voucher (Goods sent on

credit)

IV.

Supporting Voucher

SOURCE

DOCUMENTS

Name of the

Book Source

of document

I.

Cash Book Cash Memos, Cash receipts

& Issue vouchers

II.

Purchase Books Inward Invoice received from the creditors of

goods

III.

Sales Book Outward Invoice issued to debtors

IV.

Return Inward Book Debit note received from Debtors/Credit Note Issued

to debtors (Sales Return)

V.

Return Outward Book Debit Note

Issued to Creditor/Credit Note received from creditor(Purchase Return)

CONCEPT OF ACCOUNT,

DEBIT AND CREDIT

One must get cognizant with these terms before learning

actual record keeping based on the rules.

An ‘Account’ is well-defined as a summarized record of

transactions related to person or things. EX:-Customers and Vendors, for each

customer & Vendor separate account will be maintained.

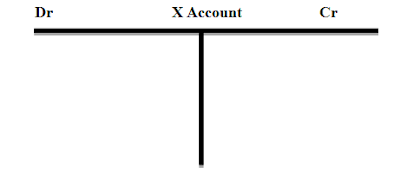

An Account is expressed as a statement in form of letter ‘T’.It

has two sides. The left hand side is called as “Debit” side and the right hand

side is “Credit” side.

Each side of the account will indicate effects, so that one

can easily take totals of both sides and find out the difference if,any.Such

difference in the two sides of an account is called ‘balance’ .If the total of

debit side is more than credit side ,the balance is called as ‘debit balance’

and vice versa .

The balance is to be computed at the end of the year (i.e.

Accounting Year).Then balances are used to prepare the trail balance.

A small business accountant doesn't have preoccupationssuch as relationships with staff and personal financial investments invested Online accountants

ReplyDeleteI read your post and this blog is very good. You have provided good knowledge in this blog .This blog really impressed me. Thank you for sharing your knowledge with all of us. Accounting Solutions Company in India

ReplyDeleteAccounts Payable And ReceivableSoftwares help to make the Payroll work easy. They are one of the payroll developing companies. They provide the best payroll outsourcing and HR Software.

ReplyDelete

ReplyDeleteInteresting Post. Keep posting like this kind of content Payroll service in bangalore . They are one of the leading software outsourcing company in India. This hr software helps in monitoring the employee salary and tax, etc. And this software is based on cloud usage.

This blog is really nice. Cloud based hrms refers to the delivery of on-demand computing resources over the internet. Instead of hosting applications or storing data on local computers or servers, cloud computing enables users to access and utilize computing resources such as servers, storage, databases, software, and networking through remote servers provided by a cloud service provider.

ReplyDelete