THREE ACCOUNTING GOLDEN PRINCIPLES

THREE GOLDEN ACCOUNTING PRINCIPLES

We have seen that an account may be related to a person or

thing(Tangible or Intangible). While doing business transactions, one may come

across numerous accounts that are affected. One has to decide about the

accounting treatment for each of the account. The accounts are classified

depending on their characteristics.

|

Let us see what each

type of accounts means

Personal Accounts :

As the name

suggests these are accounts related to persons

Natural Persons: The persons are

natural persons (Human Beings) like Rajini A/c, Shiva A/c, Rani A/c etc.

Artificial persons: The persons could

also be artificial persons like Corporates, companies or association of

persons, partnership etc. Accordingly, we could have Dr.reddy A/c, Tata A/c,

SBI bank A/c, Gupta & Trading A/c etc.

Representative Persons: There could be

representative personal accounts as well. Although the individual identify of

persons related to these is known, the convention is to reflect them as

collective accounts. EX When expenses are payable like Rent payable, Salary Payable,

Expense paid in advance, Income received in advance etc.

|

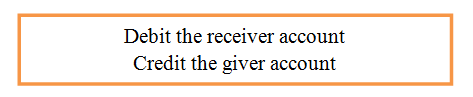

| PERSONAL ACCOUNT RULE |

Real Accounts:

These are accounts related to assets (i.e. Properties, Possessions).Depending

on their physical existence ,they are classified as follows

Tangible Real accounts: Assets

that have physical existence and can be seen, and touched. Ex-Building, land,

Machinery, Stock, cash & Vehicle etc.

Intangible Real Accounts: These Assets

that don’t have any physical existence but can measured in terms of money and

have value attached to them .Ex-Trade mark A/c, Goodwill A/c, Patents &

Copy rights, Intellectual Property Rights a/c etc.

|

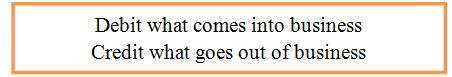

| REAL ACCOUNT RULE |

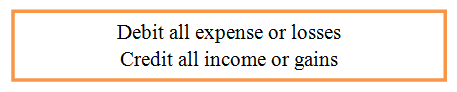

1 Nominal Account: These accounts are

related to expense or losses and income or gains Ex- Purchase A/salary A/c,

Rent A/c,Sales A/c, commission received A/c. etc.

I read your post and this blog is very good. You have provided good knowledge in this blog. This blog really impressed me. Thank you for sharing your knowledge with all of us. Accounting Solutions Company in India

ReplyDeleteThe blog on the "Three Accounting Golden Principles" offers a clear and concise explanation of accounting fundamentals, particularly beneficial for students and professionals. The principles—Personal, Real, and Nominal accounts—are thoroughly discussed, aiding in better understanding and application. For expert accounting services, consider Elite Plus Accounting

ReplyDeleteUnderstanding the three golden accounting principles is essential for accurate financial management. Integrating these with Accounting services Arnhemensures precise record-keeping, transparency, and effective decision-making for both individuals and businesses.

ReplyDeleteExcellent post. I really enjoy reading and also appreciate your work.xero bookkeeping services near me This concept is a good way to enhance knowledge. Keep sharing this kind of articles, Thank you.

ReplyDeleteYou wrote this post very carefully.Hire Xero Expert The amount of information is stunning and also a gainful article for us. Keep sharing this kind of articles, Thank you.

ReplyDeleteVery well written article. It was an awesome article to read. Complete rich content and fully informative. I totally Loved it. Read more info about Bookkeeping Services Bristol

ReplyDelete