PREPARE CASH FLOW STATEMENT IN THREE(3) STEPS

Before

going to brief discussion on cash flow statement, let us know about profit and

loss account if you give a trial balance to ten different people and ask them to

arrive profits then you will get ten different answers because of different

assumptions, but in case of cash flow the ten answers will be same as we

considering with only cash items unless non-cash items as in profit and loss

account.

Profit

is an accounting concept. Profit is derived on accrual assumption. Profit and

cash flow from operating activities are not the same. Cash flow statement is an

important tool for making several management decisions such as declaration of

dividend and investments.

Cash and Cash

equivalent

Cash

means cash n hand and balance of foreign currency. Cash equivalents implies

bank balance and other risk free short term investments, and advances which are

encashable, it includes short term highly liquid investments that are readily

convertible into cash. Equity investments are not considered as cash equivalent

because of high market risk. Investments in call money, money market mutual

funds are usually classified as cash equivalent.

Types of cash flow

Cash

flow statement explains cash movements under three different heads, such as:

Cash

flow from operating activities

Cash

flow from investing activities

Cash

flow from financing activities

Sum

of these three activities of cash flow reflects net increase or decrease of

cash and cash equivalents.

Operating activities are the principal revenue producing

activities of the enterprise and other activities that are not investing and

financing.

Elements of operating

cash flow

Cash

receipts from sale of goods and services

Cash

receipts from royalty, fees, commissions and other revenue.

Cash

payment to suppliers of goods and services

Cash

payment to employees

Cash

payment and refunds of income taxes

Depending

on type of business the elements will changes

Insurance companies: Cash receipts and cash payment by

way of premiums and claims, annuities and other policy benefits

Banking companies: Cash receipt and cash payment by way

of interest earned, commission earned , interest paid etc

Investing activities are the purchase and sale of long

term assets and other investments not included in cash equivalents.

Elements of investing

cash flow

Cash

payments for acquisition of fixed assets

Cash

receipts from sale of fixed assets

Cash

payments to acquire shares, debt instruments of other companies(excluding items

covered under cash equivalents)

Cash

receipts from sale of shares, debt instruments of other companies(excluding

items covered under cash equivalents)

Financing activities are the activities that result in

changes in the size and composition of the owners capital including preference

shares capital.

Elements of financing

cash flows

Cash

proceeds from issuing of shares or other equity instruments.

Cash

payments to owners to acquire shares ( Buy back of shares)

Cash

proceeds from issuing debentures ,loans, notes, bonds etc.

Cash

repayment of amount borrowed.

Ass

per accounting standard 3 there two methods for preparing cash flow statement

- Direct method

- Indirect method

Here

we are going to prepare cash flow statement under indirect method which is very

popular.

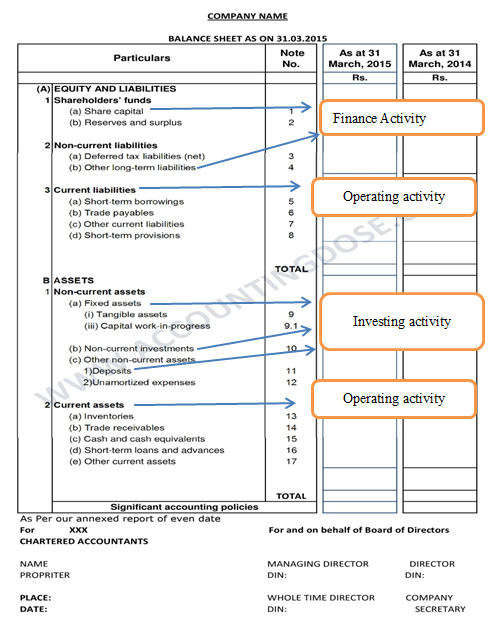

Step 1

Acquire all relevant

data required to prepare cash low such as balance sheet and statement of profit

and loss.

Step 2

Classify the items

into three groups such as operating, Investing, Finance

Current

assets and current liabilities are classified as operating activity

Non-

current assets such as fixed assets and investment are classified as investing

activity(Exclude unamortized expense)

Share

holder funds such as share capital and preference capital are classified as

Financing activity

In case of

Profit and loss

After classification of items in operating, Investing, and Finance substitute

values in cash flow statement ,the changes in current assets(I.e increase or

decrease compared with previous year) shall be done with care.

Following is the cash flow statement

under indirect method

super

ReplyDeleteVery Helpfull for all

ReplyDeleteNice Post For More Info Visit: Accounting outsourcing companies

ReplyDeleteCash flow management Pretty good post. I just stumbled upon your blog and wanted to say that I have really enjoyed reading your blog posts. Any way I'll be subscribing to your feed and I hope you post again soon. Big thanks for the useful info.

ReplyDeleteThis comment has been removed by the author.

ReplyDeleteThanks for your post. I am looking this type of informative blog long time and find your blog that provides information that I am looking for. Looking forward to reading another post like this one.

ReplyDeletehttps://liquiditycurve.com/

https://liquiditycurve.com/

DeleteThis comment has been removed by the author.

ReplyDeleteClearly, It is an engaging blog for us that you have provided here about Saudi Arabian Cash Flow Statement This is a great resource to enhance our knowledge about it. Thank you.

ReplyDeleteAlmost every online on line casino offers varied types of bonuses to players who're new and 1xbet players who're loyal. This isn't a separate sort of free spins bonus based on the worth of each spin. Getting Cash Spins implies that it doesn't matter what} slot they apply to, whatever you win out of your spins is paid out in cash and never as bonus money. When it comes to the biggest bonus offers on the slots, Cafe Casino is most certainly properly placed atop the pile as one of the best new online casinos. Some of the promotions available for newcomers embrace a 350% welcome bonus and a 100% reload bonus for existing users.

ReplyDelete